reit dividend tax rate

The remaining 060 comes. Second your REIT can also provide you with.

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

They hit my regular tax bucket just like all my other regular income does.

. We call non-qualified REIT dividends Section 199A dividends. If the property was owned for a year or more though it is considered a long-term gain and is taxed at either 0 15 or 20. By 2026 the rate will be 6 plus a third.

So if youre in the 24 tax bracket the IRS applies that tax rate to most dividends you receive from your. There is no cap on the deduction no wage restriction and itemized deductions are not required to receive this benefit. 710 if shareholder owns at least 10 of the REITs voting stock.

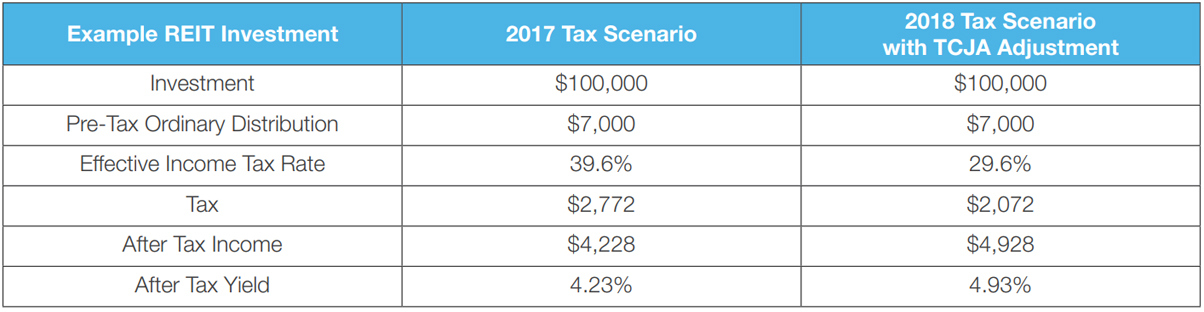

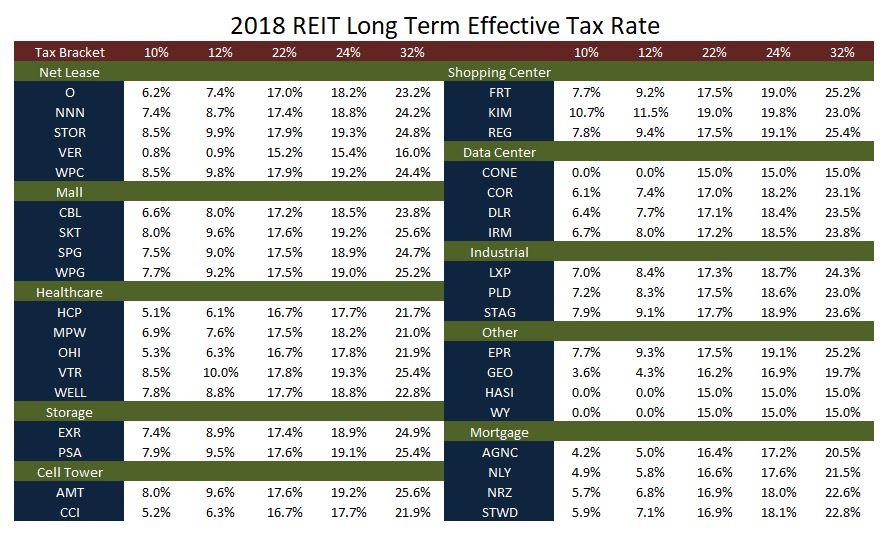

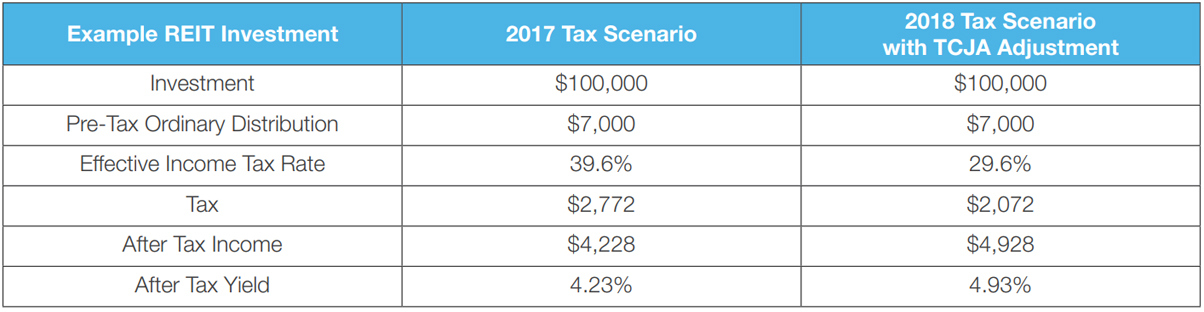

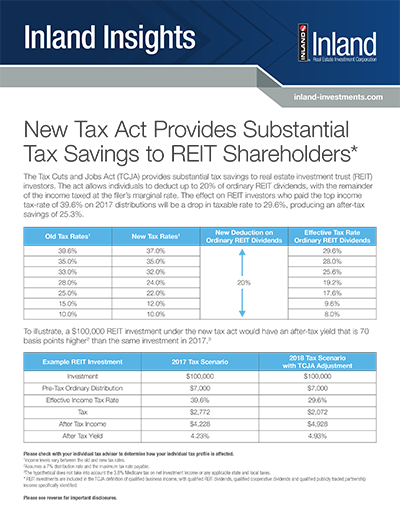

Max OOP and I that comes out. Individuals are now permitted to deduct up to 20 of ordinary REIT dividends. The tax law effectively lowered the federal tax rate on ordinary REIT dividends mortgage REITs included from 37 to 296 for a taxpayer in the highest bracket.

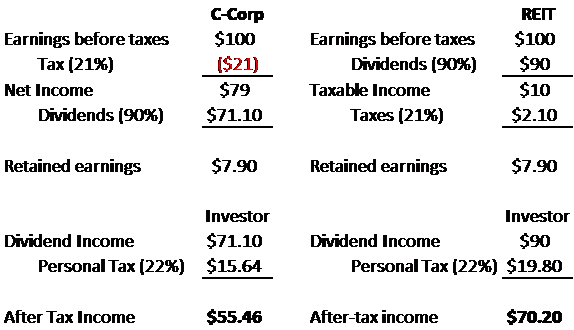

Are REIT dividends subject to the maximum tax rate. Learn What We Can Do. In exchange for meeting certain requirements -- in particular paying at least 90 of their taxable income to shareholders as dividends -- REITs pay no corporate tax whatsoever.

Get your free copy of The Definitive Guide to Retirement Income. Ad Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios. We Advise More REITs than Any Other Professional Services Firm.

65 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is declared. Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives. Ad Our Knowledge Experience and Capabilities Make Us the Leader in Serving REITs.

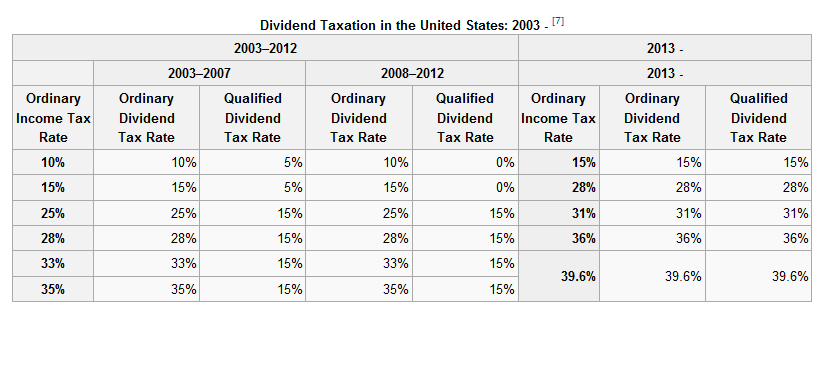

PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the shareholder. Dividends from REIT companies are taxed at a maximum rate of 37 returning to 39 percent. Ad Explore Alternative Investments With Insights and Guidance From the Private Bank Team.

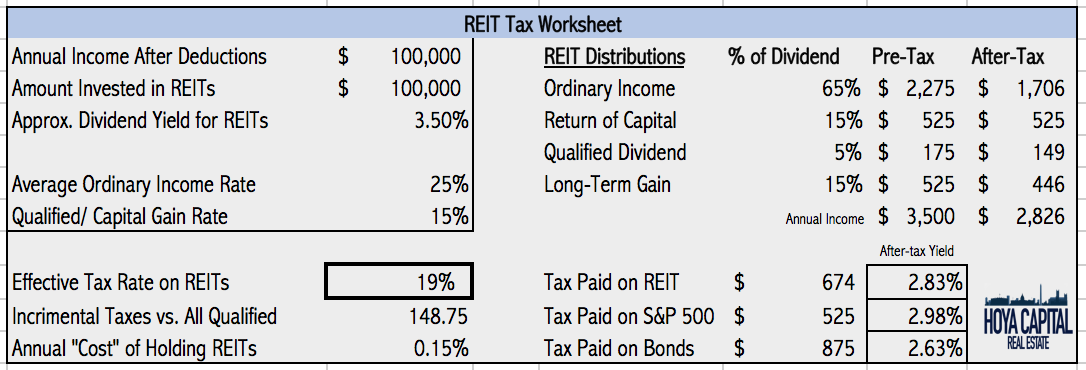

The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate. This provision qualified business income effectively.

Investment income is subject to an 8. Of this 120 of the dividend comes from earnings. The majority of REIT dividends are ordinary income for tax purposes.

7 rows Most REIT distributions are considered non-qualified dividends which means that they do not. This level is still above the. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

That provides a slight reduction in tax rates while simultaneously amounting to an after-tax savings.

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

Guide To Reits Reit Tax Advantages More

Reit Taxation A Canadian Guide

The Most Important Metrics For Reit Investing Intelligent Income By Simply Safe Dividends

How To Pay No Tax On Your Dividend Income Retire By 40

Sec 199a And Subchapter M Rics Vs Reits

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Guide To Reits Reit Tax Advantages More

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How Tax Efficient Are Your Reits Seeking Alpha

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

The High Yield Potential From Reit Dividends Considering Taxes And Safety

Reits In India Features Pros Cons Tax Implications

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha