corporate tax increase canada

It is time for corporate tax reform in Canada. Corporation income tax overview Corporation tax rates Provincial and territorial corporation tax Business tax credits Record keeping Dividends Corporate tax payments Reassessments.

To help Canadians in the future the Canada Revenue Agency is taking out increasing CPP premiums from 2019 to 2023.

. If you are self-employed your maximum contribution is doubled at up to 699960. Budget 2022 included two taxes targeting banks and life insurers the first being a one-time 15 tax referred to as the Canada Recovery Dividend and the second being an ongoing increase of 15 to the general corporate income tax rate as it applies to such taxpayers. A federal rate of 9 applies to the first CAD 500000 of active business income.

Corporate tax revenue as a share of GDP in Canada has averaged 33 percent since 2000 while it averaged 29 percent over the years 1988 to 2000 when Canadas corporate tax rate was 43 percent. Fortunately governments in Canada have recognized the damaging effects of corporate taxes. The corporate tax rate on large financial institutions mostly banks and life insurers would climb three percentage points to 18 from 15 and apply to earnings above 1 billion Canadian dollars.

BUSINESS TAX MEASURES Financial Institution Measures. The net tax rate for Canadian-controlled private corporations that claim the small business deduction is nine per cent. The basic rate of Part I tax is 38 of your taxable income 28 after federal tax abatement.

Corporate taxes in Canada are regulated at the federal level by the Canada Revenue Agency CRA. For small CCPCs the net federal tax rate is levied on active business income above CAD 500000. 7 Saskatchewans Bill 2 which received Royal Assent on Dec 10 2020 reduced the Small Business corporate tax rate to 0 effective Oct 1 2020 with an increase to 1 on Jul 1 2022 and to 2 on Jul 1 2023.

Canadas major banks are expecting larger tax bills in 2022 as a new surcharge on financial institutions profits over 1-billion could be pushed through by. The maximum pensionable earnings is 64900 an increase of 3300 from the 61600 in 2021. As of January 1 2019 the net tax rate after the general tax reduction is fifteen per cent.

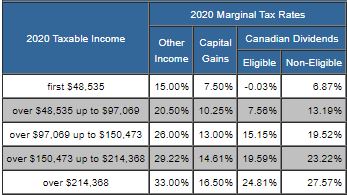

As a result of the small business rate changes Bill 2 also adjusts the dividend tax credit for non-eligible dividends beginning in 2021 resulting in a top marginal tax rate for noneligible dividends as follows. Each annual increase is small but it adds up to a 167 hike over the five years of enhancement. On average across the provinces the corporate tax rate for small Canadian-controlled private corporations CCPCs is now 15 percent compared to an average top personal tax rate of 52 percent.

Canada imposes very low corporate tax rates on small businesses. 14 rows This translated to the reduction of Albertas general corporate income tax rate from 10 percent. Investment income other than most dividends of CCPCs is subject to the federal rate of 28 in addition to a refundable federal tax of 10⅔ for a total federal rate of 38⅔.

The CRA has increased the 2022 age amount by 185 to 7898 which will reduce your federal tax bill by 1185 15 of 7898. According to OECD data corporate tax revenue increased following Canadas corporate tax rate cuts that began in 2000. 10 effective January 1 2018.

Then theres the increase in CPP pensionable earnings. Budget 2022 targets banks and life insurers with a one time 15 tax referred to as the Canada Recovery Dividend and an ongoing increase of 15 to the general corporate income tax rate as it applies to banks and life insurers. The NDP proposal would slap an additional 15 per cent on profits over a set amount.

For Canadian-controlled private corporations claiming the small business deduction the net tax rate is. 9 effective January 1 2019. File corporation income tax find tax rates and get information about provincial and territorial corporate tax.

Canada Recovery Dividend and Additional Tax on Banks and Life Insurers. Eliminate many of these tax preferences increase the tax rate for SMEs and modestly reduce the general corporate rate of 27 per cent. Canada Recovery Dividend and Additional Tax on Banks and Life Insurers.

One of Canadas most important positive policy reforms over the past 15 years has been on corporate taxes. Under these most recent changes the corporate tax rate is now proposed to increase to 265 from 21 and the top marginal individual income tax rate would rise to 396 from 37 among other amendments. Increase the small business income tax rate back to its current rate of 2 from 1 beginning 1 July 2023.

Corporate Tax Rate in Canada is expected to reach 2650 percent by the end of 2020 according to Trading Economics global macro models and analysts expectations. Based on the statistical results a one percentage point drop in the combined corporate tax rate would increase the average wage of Canadian workers by between 254 and 390 the following year. The basic exemption amount remains at 3500 in 2022.

If you earn over 58700 this will increase your CPP premiums too. Federal and provincial governments of all political stripes realized the economically damaging effect of corporate income taxes and lowered rates to make the business tax regime more competitive. The first chart below shows the data.

6 Northwest Territories 2021 Budget reduced the small business corporate income tax rate from 4 to 2 effective January 1 2021. Financial Post Allan. In short Canada is losing tens of billions of dollars of corporate tax revenue every year the lions share being the result of politically expedient corporate tax handouts.

In Canada corporate income is taxed at 15 per cent although some businesses qualify for lower deductions. You can expect to pay up to 349980 in CPP contributions this year. Raising corporate taxes is bad economic policy.

After the general tax reduction the net tax rate is 15. Non-eligible dividend tax credit. For instance Emmas 2021 and 2022 taxable income remains.

In the long-term the Canada Corporate Tax Rate is projected to trend around 2650 percent in 2021 according to our econometric models.

Pin By Maria Roma On Tax Tips Canada Artists Canadian Money Income Tax Tax Prep

File Taxes Online For Free With H R Block Canadian Tax Software Online Taxes Tax Software File Taxes Online

7 Last Minute Tax Breaks To Take Advantage Of Before The End Of The Year Tax Time Filing Taxes Savings Strategy

Net Household Savings Rate In Selected Countries 2019 Basic Concepts Household Savings

Taxtips Ca Business 2020 Corporate Income Tax Rates

Taxtips Ca Federal 2019 2020 Income Tax Rates

Bookkeeper And Tax Preparation In Calgary Canada Accounting Firms Tax Accountant Tax Preparation

Filing Your First Tax Return In Canada In 2020 Tax Return Side Hustle Tax Season

Premium Vector Corporate Business Infographic Template Composition Of Infographic Elements Business Infographic Business Infographic Design Infographic Design Template

Home Business Canada Tax Deductions Home Business Expenses For Taxes Around Home Based Business Tax Deducti Affirmation Quotes Affirmations Daily Affirmations

Higher Or Lower How Do You Think Your U S Tax Burden Compares To Other Countries Thinking Of You Other Countries Lower

Accounting Services Canada Outsource Bookkeeping Canada Outsourcing Accounting Services Bookkeeping Ser Accounting Services Bookkeeping Bookkeeping Services